Solutions to mitigate future materials supply vulnerabilities

By Lita Shon-Roy, MS/MBA, and Sachi Brown, TECHCET CA

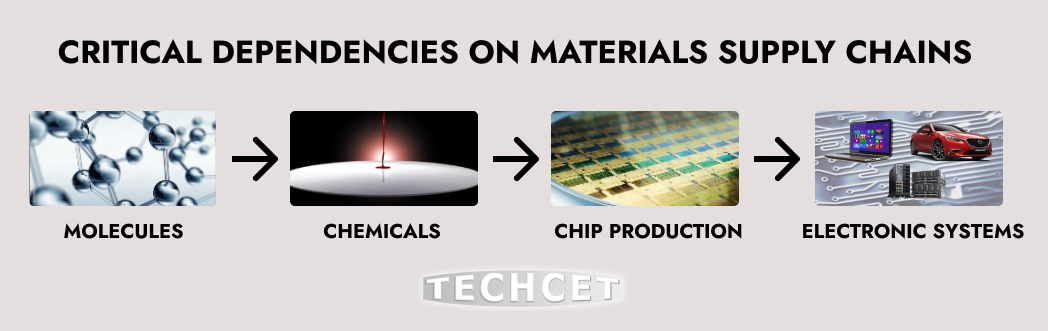

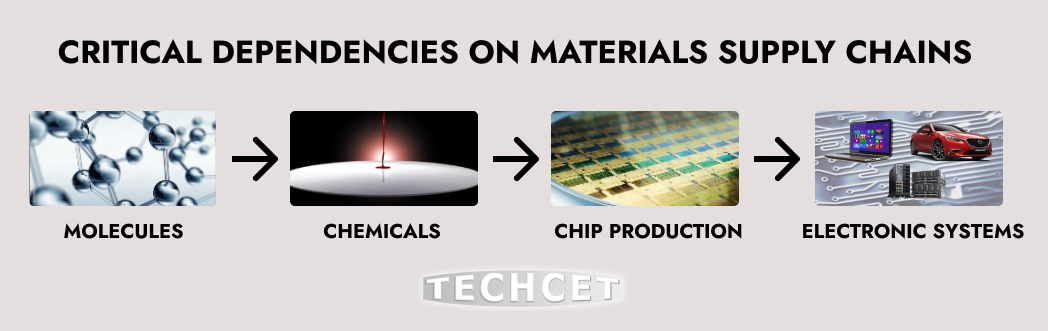

Over the past 2 to 3 years, the semiconductor industry has faced extreme pressure to meet growing consumer demand for an abundance of everyday electronic products like cars, smartphones, and computers. This pressure has only been amplified by various supply chain issues stemming from the raw material sources that are essential to building semiconductors. These material dependencies are easy to overlook since they reside in the sub-tier of the semiconductor market, hidden from direct view of what is sold to chip fabricators and consumers. TECHCET, a leading materials supply chain analysis firm, has consistently worked to uncover many of these dependencies, such as for fluorspar, neon, and helium. These materials play an essential role in the supply chain lifeline to the semiconductor industry and require expertise to identify, qualify, and track for the efficient forward movement of the market.

With recent chip shortages, various producers around the world have announced plans to invest in chip expansions that total more than US$500B over the next five years. For the US alone, this equates to an increase of >45% in semiconductor wafer starts by 2026. While this sounds hopeful for resolving chip deficiencies, it still does not address one key weakness: material shortages. As the industry expands, the risk of complications to the semiconductor supply chain grows, elevating the importance for material supply chain tracking and analysis.

Sulfuric acid is one example of an essential material that would put the semiconductor supply chain at risk if its supply is not properly managed. Fortunately, TECHCET has identified a >50% increase in demand for US sulfuric acid by 2026 to help key chip fabs prepare for expansions. TECHCET consistently provides key metrics related to supply and demand to the Critical Materials Council (CMC), a consortium formed in the mid-1990’s made up of chip fabricators and material suppliers. The Council also provides feedback to TECHCET to direct their ongoing supply chain analysis work. Identifying materials-related disruptions, dependencies, and weaknesses within the supply-chain, are all key elements of TECHCET’s focus and benefits to the CMC subscriber members.

In recent years, material shortages from the Russia-Ukraine conflict and COVID-19 have proven to be high stress points for chip fabricators and material suppliers. For example, neon gas faced shortages at the onset of the Russia-Ukraine war, threatening the stability of semiconductor production and causing high anxiety among chip fabs. At the time, it was unknown how much the US and Asia relied on Ukraine for neon supply. TECHCET managed to uncover various dependencies on Ukrainian neon from different regions around the world, helping major chip companies re-evaluate and better stabilize their supply chains. During the COVID pandemic, sporadic and extreme ocean freight roadblocks also contributed to slowdowns in chip manufacturing. In response to these disruptions, CMC subscriber companies met with logistics and shipping port officials to improve mitigation strategies for further supply interruptions.

CMC member subscribers also gain insight into supply chain challenges from the

CMC Seminar. The next one will be hosted in Taiwan (October 25) and will focus on current problems in the materials supply chain and future quality requirements. This event is one of several that brings conversation on supply issues to the forefront. These events connect the entire semiconductor ecosystem by providing essential information on critical materials needed by decision makers at chip fabricators, suppliers, and government. The current CMC chip fab subscribers include more than a dozen of the world’s largest chip makers. (Reference:

https://cmcfabs.org)

Given the massive impact semiconductors have in our digital global society, there is a growing and persistent need to manage the coming supply-chain issues, especially with expectations for chip volume to sharply ramp come 2025-2026. Looking into the future, TECHCET and the CMC will continue to facilitate coordination among key players in the materials and chip industry to navigate what lies ahead.

Lita Shon-Roy is President/CEO of TECHCET CA LLC, an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries.

Sachi Brown is the Marketing Specialist of TECHCET CA LLC, in charge of marketing communications.

%20(1).png)