Congratulations to 2021 ALD Innovator Awardee Stacey Bent @BentGroup (Stanford University, USA)! pic.twitter.com/8AoAFpGSl4

— AVSALD (@AvsAld) June 28, 2021

Wednesday, June 30, 2021

Congratulations to 2021 ALD Innovator Awardee Stacey Bent (Stanford University, USA)!

The ALD conferences for the next coming years were just announced!

The AVS ALD and ALE conferences for the next coming years were just announced!

2022 - Ghent, Belgium

2023 - Bellevue, Washington, USA

2024 - Helsinki, Finland

2022 - Ghent, Belgium

2023 - Bellevue, Washington, USA

2024 - Helsinki, Finland

Thursday, June 24, 2021

Picosun strengthens its presence in Southeast Asia

ESPOO, Finland, 24th June 2021 – Picosun Group extends its global sales and service partner network further by signing a partner agreement with Hermes-Epitek Corporation Pte. Ltd. Hermes-Epitek Corporation, headquartered in Taiwan, is one of the world’s largest high-tech equipment distributors. The company provides equipment for semiconductor and optoelectronic manufacturing, as well as tech services and parts sales.

“We look forward to cooperate as Picosun’s sales representative and external field service provider targeting both 8-inch and 12-inch ALD markets in all Southeast Asia countries”, states Teo Kim Leong, Director, Hermes-Epitek Corporation.

“Southeast Asia is one of Picosun’s important market areas, where the demand for industrial ALD solutions is constantly increasing. For almost ten years now, Picosun has successfully provided world leading ALD solutions to numerous customers and partners in both academies and industries in Southeast Asia. I’m happy that with the partnership with Hermes-Epitek Corporation we are able to serve our customers in the region even better”, says Edwin Wu, CEO, Picosun Asia Pte. Ltd.

Picosun provides the most advanced AGILE ALD® (Atomic Layer Deposition) thin film coating solutions for global industries. Picosun’s ALD solutions enable technological leap into the future, with turn-key production processes and unmatched, pioneering expertise in the field – dating back to the invention of the technology itself. Today, PICOSUN® ALD equipment are in daily manufacturing use in numerous leading industries around the world. Picosun is based in Finland, with subsidiaries in Germany, USA, Singapore, Japan, South Korea, China mainland and Taiwan, offices in India and France, and a world-wide sales and support network. Visit www.picosun.com.

More information:

Edwin Wu

CEO

Picosun Asia Pte. Ltd.

Tel. +358 40 480 3449

Email: info@picosun.com

Thursday, June 17, 2021

Picosun is part of world's first wooden satellite coated by ALD

Picosun is part of world's first wooden satellite, Wisa Woodsat, launched to space during this year. The wood used in the satellite is ALD coated with Picosun tools to make the wood impermeable and meet the requirements of the most demanding environment.

WISA WOODSAT is a nanosatellite based on the popular CubeSat standard. The satellite measures roughly 10 x 10 x 10 cm, which is equivalent of 1U CubeSat. The satellite is designed and built in Finland and it will be launched to space during the fall of 2021 with a Rocket Lab Electron rocket from the Mahia Peninsula launch complex in New Zealand.

The mission of the satellite is to test the applicability of wooden materials, especially WISA-Birch plywood in spacecraft structures and expose it to extreme space conditions, such as heat, cold, vacuum and radiation, for an extended period of time.

Source: WISA WOODSAT (LINK)

Saturday, June 12, 2021

Vinova fund Swedish AlixLabs Breakthrough green technology in Nanostructures Miniaturization for Electronic Chips

Vinnova has decided to grant AlixLabs application to Innovative Startups step 2 "Breakthrough green technology in Nanostructures Miniaturization for Electronic Chips" in the spring of 2021. 140 applications were received for the call, of which 35 were given grants. The assessment is based on a weighting of the six main criteria Relevance, Potential, Team, Implementation, Sustainability, and Gender Equality. The applications have been assessed in competition with each other. AlixLabs application was judged to meet the criteria to a great extent.

AlixLabs aim to validate our breakthrough green technology for nanofabrication of nanostructures for applications in electronic chips. It is to demonstrate that Alixlabs' method is technically viable for the production of low dimensional transistors down to 2 nm node size, in line with the newly designed European Flagship "A European Initiative on Processors and semiconductor technologies" (LINK) to develop next-generation chips and 2 nm technology with €146.5 B, supported by 22 EU members. This demonstration will minimize the risks for AlixLabs entering the semiconductor industry market and ecosystem.

Miniaturization of electronic components, known as Moore's law, is fundamental to the entire IT explosion leading to the fast processing of data. Production of sub 10 nm chips requires advanced equipment such as extreme UV lithography (EUVL) tools, costing over €100 million, not affordable to all manufacturing companies or adding extreme investment cost for those companies still in the scaling race. Our innovative patented technology (WO2017157902A1) enables miniaturization without requiring or reducing the number of process steps using costly EUVL. This way, less financially powerful manufacturers (fabs) can get back to semiconductor production chains on level terms with large competitors from the USA and Asia. Our technology uses Atomic Layer Etching (ALE) for pitch splitting of nanostructures, which allows for efficient and high-volume nanopatterning and offers to reduce operating cost up to 35 - 50% and energy use and greenhouse emissions by 25 - 50% per Lithography mask layer requiring advanced Immersion base multiple patterning technology or EUVL single and double exposure.

BREAKTHROUGH DEVELOPMENTS

We envision two breakthrough developments in this project:

(1) Application of ALE pitch splitting nanofabrication for electronic chip manufacturing down to 2 nm Foundry node size

(2) Demonstration of first transistors produced by ALE pitch splitting

Vinnova is the Swedish government agency that administers state funding for research and development. The agency's mission as defined by the government is to promote the development of efficient and innovative Swedish systems within the areas of technology, transportation, communication and labour.

About AlixLabs AB:

AlixLabs (www.alixlabs.com) is an innovative startup enabling the semiconductor industry to scale down Logic and Memory components in a cost-effective manner by the use of ALE Pitch Splitting (APS).

Background Information:

Lund Nano Lab: https://www.nano.lu.se/facilities/lund-nano-lab

IDEON Science Park: https://www.ideoninnovation.se/our-startups

Applied Materials to present New Innovations Needed to Continue Scaling Advanced Logic (June 16)

Applied Materials (Santa Clara, USA): The semiconductor industry is at a crossroads. Demand for chips has never been greater as we enter the early stages of a new wave of growth fueled by the Internet of Things, Big Data and AI. At the same time, it’s become apparent that conventional Moore’s Law 2D scaling techniques are no longer able to deliver the consistent improvements in power, performance, area-cost and time to market (PPACt) that chipmakers have long relied on. This is particularly the case for logic chips, which serve as the main processing engine in nearly every electronic product and where power efficiency and performance are critical.

To shed light on this issue, Applied Materials is hosting an online Logic Master Class on Wednesday, June 16. I will be joined by other experts from Applied and the industry to discuss the logic scaling roadmap, including challenges and solutions for delivering continued improvements in PPACt. We will be exploring several different areas, including transistor and interconnect scaling, patterning and design technology co-optimization (DTCO). The common denominator underlying all of these areas is the need to supplement classic 2D scaling with a combination of approaches that includes new chip architectures, new 3D structures, novel materials, new ways to shrink features and new ways to connect chips with advanced packaging.

Source: Applied Materials Blog (LINK)

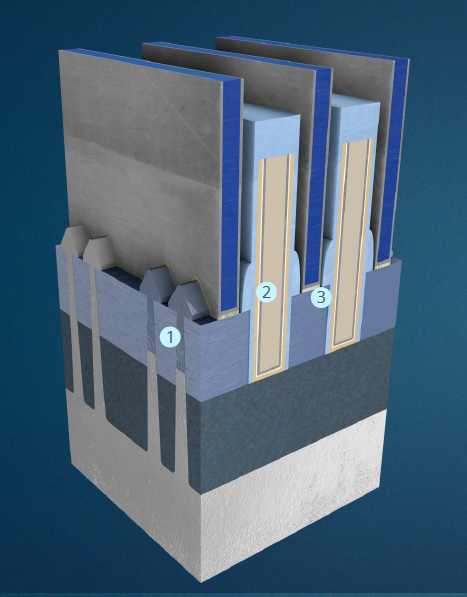

Primary modules of a FinFET are channel and shallow trench isolation (1), high-k metal gate (2) and transistor source/drain resistance (3). (Credit: Applied Materials)

Wednesday, June 2, 2021

Picosun’s PicoArmour(TM) reduces semiconductor manufacturing costs

ESPOO, Finland, 2nd of June 2021 – Picosun Group has pending patent rights for an ALD enabled corrosion protection solution against plasma etch that will bring benefits in semiconductor fabrication processes in terms of throughput, film uniformity and conformality. With PicoArmourTM the corrosion protection can be achieved more efficiently compared with the industry solutions commonly used today.

Wafer fabrication process flows include several steps where plasma etching is necessary. An inevitable consequence of using etching chemicals is that the tool itself will be etched. A common industrial solution for reducing the tool damage is applying a corrosion-resistant coating to the etch tool using for example PVD or spray coating with Y2O3. Compared to only using Y2O3, PicoArmourTM enables an up to five times faster and a more cost-effective way of producing the coating. Compared to Al2O3, the coating can be five times more durable.* Also, the maintenance interval of etch tools can be increased which also translates to significant reduction of manufacturing costs.

“Picosun’s approach with PicoArmourTM is to combine the highly-etch-resistant Y2O3 ALD process with more robust ALD processes. A high performance ALD corrosion barrier combining the speed and convenience of Al2O3 process with the durability of Y2O3 can be achieved by carefully controlling the film composition. With ALD, the protective effect can be achieved with thinner films, which in turn leads to material savings and a more environmentally friendly process”, states Juhana Kostamo, VP, Industrial Business Area of Picosun Group.

To learn more about PicoArmourTM and a study Picosun has done related to protective coatings against plasma damage, join Picosun talk at the virtual ALD 2021 conference on June 29 at 10:25 am EDT.

Register here.

Tuesday, June 1, 2021

South Korean equipment makers recorded mixed results in the first quarter of 2021

출처 : THE ELEC, Korea Electronics Industry Media(http://thelec.net) - South Korean equipment makers recorded mixed results in the first quarter of 2021.

- Fab equipment vendors posted high growth, while display equipment firms underperformed.

- Fab equipment makers benefited from aggressive spending by semiconductor companies.

- CVD/ALD equipment companies showed good growth, see below (Jusung, Wonik IPD, Eugene Technologies

Semes, Samsung Electronics’ fab equipment subsidiary, recorded 870.6 billion won in sales, an increase of 62.3% from a year prior. It recorded 112.8 billion won in operating income, an increase of 40.5% over the same time period. The growth likely stems from Samsung starting to put in equipment to its P2 chip line at its Pyeontaek plant during the quarter. Overheat transport accounted for 60% of the sales recorded by Semes during the quarter.

SFA recorded 355.6 billion won in sales and 42.3 billion won in operating income, a drop of 3.3% and 1.6%, respectively, a year prior. Non-display business accounted for 65.1% of its sales. SFA, which previously focused on display kits, managed to record level earnings to a year prior thanks to other business areas.

Wonik IPS recorded 254.5 billion won in revenue and 24.2 billion won in operating income, a surge of 39.9% and 68.1%, respectively, from a year prior. The firm previously focused on fab equipment for use in memory chip production. But it has begun supplying kits for foundry beginning last year, which helped growth.

Eugene Technology recorded 100.7 billion won in revenue and 30.7 billion won in operating income. The company recorded an operating margin rate of 30.5%. Its LPCVD equipment supplied to SK Hynix for the latter’s M16 DRAM fab led the growth.

Jusung Engineering posted 75.3 billion won in sales in the quarter, double that of the year prior. It turned a profit from a year prior and posted 16 billion won in operating income. The company won the order for atomic layer deposition kits from SK Hynix for use in next-generation DRAMs. Jusung is the sole supplier of the kits.

Hanmi Semiconductor recorded 70.9 billion won in sales, a jump of 79% from a year prior. Its operating income increased 160% year-on-year to 19.3 billion won. It won 22 orders during the quarter. It has signed supply deals with SK Hynix, Amkor Technology Korea, ASE, NXP, Nanya, SPIL and others for a combined worth of 87 billion won.

YIK recorded 67.5 billion won in sales and 9.7 billion won in operating income, a jump of 99.7% and 177.1%, respectively, from a year prior. The firm mainly provides electrical die sorting equipment. The firm is seeing more orders from Samsung, having signed a 155.3 billion won deal with the tech giant in the first quarter alone.

South Korean fab equipment makers are expected to post solid growth throughout 2021 from increased spending this year by Samsung and SK Hynix. SK Hynix had said in the conference call for the first quarter that it plans to execute some of its spending it planned for 2022 earlier to this year.

SEMI is expecting global fab equipment spending to increase 15.5% this year to US$70 billion. Meanwhile, South Korean display equipment makers underperformed during the first quarter.

Samsung Display and LG Display have been conservative with their spending due to uncertainties surrounding the display market. But increased spending in OLED from Chinese panel makers such as BOE and Tianma staved off a huge dip in profitability.

Only few companies recorded growth, such as AP Systems, which saw sales drop 6.9% year-on-year but operating income surge 53.2% over the same time period. The company benefited from laser annealing equipment supplied to BOE for the B12 line.

Youngwoo DSP saw a surge in its operating income from supplies to its Chinese customers. KC Tech saw sales jump 21.1% but operating income remained flat. Top Engineering saw 9.6 billion won in operating loss from the 6.1 billion won operating loss posted by subsidiary Powerlogics. Dong A Eltek recorded 2.3 billion won in operating loss, though sales doubled. The firm said increased cost from the pandemic stunted growth.

Charm Engineering continued to record loss. HB Technology, Toptec and Philoptics all turned to the red.

Local display equipment makers are expected to see a turnaround starting in the fourth quarter when Samsung Display and LG Display decide on new spending plans around the same time.

Subscribe to:

Posts (Atom)

%20(1).png)