- Globalfoundries Fab1 in Dresden Germany

- STMicro Corlles in Grenoble France

- Infineon Dresden, Germany

- Infineon Villach, Austria

- Bosch Sensortech Dresden, Germany

- Intel Leixlip,

Thursday, December 17, 2020

EU Signs €145bn Declaration to Develop Next Gen Processors and 2nm Technology

Wednesday, December 2, 2020

The global semiconductor market is projected to grow by 8.4 percent in 2021 according to WSTS Forecast

Tuesday, September 22, 2020

Semiconductor Materials Market to Hit $50B in 2020 Up 3% Winds Reverse on the Global Supply-Chain Seas

September 21, 2020:

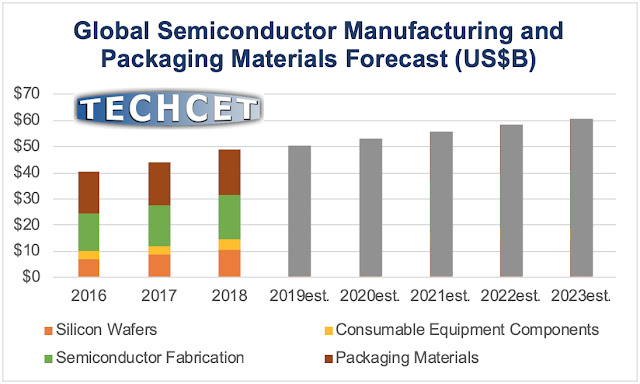

TECHCET announces that 2020 global materials revenues in semiconductor

fabrication are now forecasted upward year-over-year (YoY) despite

potential disruptions to manufacturing:

- Overall revenues +2.8% to hit over $50B, versus outlook in April for -3%,

- Front End Materials +5% to hit $16.4B, and

- Equipment Components +10% to hit $3.8B.

While

the impact of COVID-19 on the global economy is serious, IC fabrication

is steady for devices to Work From Home (WFH) and School From Home

(SFH). As predicted, leading-edge ICs to build out data centers are in

strong demand this year, as part of forecasted 5.4% Compound Annual

Growth Rate (CAGR) for fab materials through the year 2024 (Figure

below).

“TECHCET now sees Front-End Materials volumes and

revenues for the year 2020 to be buoyed up by cloud computing and

devices to support Work From Home and School From Home,” remarked Lita

Shon-Roy, TECHCET President and CEO.

For Critical Materials Reports™ and Market Briefings: https://techcet.com/shop/

To register for 2020 CMC Conference: https://lnkd.in/eARPxRJ

Tuesday, April 28, 2020

CMC Workshop Flags Looming Shortages of IPA and Sulfuric Critical Materials

ABOUT TECHCET: TECHCET CA LLC is an advisory service firm focused on process materials supply-chains, electronic materials technology, and materials market analysis for the semiconductor, display, solar/PV, and LED industries. Since 2000, the company has been responsible for producing the Critical Material Reports™ for the Critical Materials Council (CMC), covering silicon wafers, semiconductor gases, wet chemicals, CMP consumables, Photoresists, and ALD/CVD Precursors. For additional information about these reports or CMC subscription membership please contact info@techcet.com, +1-480-332-8336, or go to www.techcet.com.

Monday, April 20, 2020

Report: Chip Demand to Drop 5% to 15% in 2020

Research firms IC Insights and Gartner have also revised their projections downward; IC Insights predicts a 4% drop for this year, and Gartner forecasts a 0.9% decline in semiconductor revenue.

Choppy Waters for Shipping $50B of Semiconductor Materials in 2020

Risky Sailing on the Global Supply-Chain Seas

San Diego, CA, Apr 17, 2020:TECHCET announces that:• Impact of COVID-19 pandemic on the global economy is creating choppy waters for shipping and supplying critical materials, as highlighted in recent Critical Materials Council (CMC) monthly meetings, and

• With a return of global economic growth by 2021, compound annual growth rate (CAGR) through 2025 is forecast at 3.5% as shown in the Figure (below).

“From our market research, materials suppliers are increasing production and sales to ensure safety-stock throughout the supply-chain in case there are further disruptions due to COVID-19 cases,” remarked Lita Shon-Roy, TECHCET President and CEO. “Even without further disruptions, we can already see leading economic indicators such as unemployment levels, metal prices and container shipping indices point toward a significant decline in global GDP.” This is supported by the International Monetary Fund’s (IMF’s) current outlook on 2020.

Currently, almost all chip fabs appear to be running at normal levels, with a few exceptions. During this difficult period, YMTC in Wuhan, China reportedly has maintained R&D and grown production of 3D-NAND chips. However, chip fabs in Malaysia report that the government required companies to request permission to continue operating at 50% staffing levels. One company in France had to temporarily reduce production due to their labor union insisting on temporary workforce reductions.

Significant value-added engineered materials including specialty gases, deposition precursors, wet chemicals, chemical-mechanical planarization (CMP) slurries & pads, silicon wafers, PVD/sputtering targets, and photoresists & ancillary materials for lithography are reporting healthy orders and in some cases will see better than expected revenues for 1Q2020 and April 2020. However, more than 60% of all materials are expected to be negatively impacted before year-end.

Overall demand for commodity materials, such as silane and phosphoric acid, is expected to decline YoY in 2020 by an average of 3% due to softening of the global economy. Average selling prices (ASP) for electronic-grade commodities may drop due to cost reductions in feed-stocks; for example, the global helium (He) gas market which had been forecasted to be in shortage with high ASPs throughout 2020 has already improved due to COVID-19 slowing down helium demand.

DRAM, 3D-NAND, and MPU chips for server / cloud-computing applications are now in high demand for virtual meetings and remote work. It is yet unclear how much of an increase in materials shipments will be needed to support this segment, however from TECHCET’s modeling of prior cycles it will likely be >7%. Despite such an increase in the materials used to make leading-edge ICs to build out data centers, shipments in support of legacy node IC fabrication are expected to decline this year.

Consequently, cloud-computing growth may not compensate for overall reduced semiconductor materials demands caused by economic downturns this year. By 2021 the global economy and all chip fabs should return to healthier growth, with materials markets for all IC devices expected to increase at a CAGR of +3.5% through 2025.

Critical Materials Reports™ and Market Briefings: TECHCET Shop

CMC Events: Click here to view all Events

Saturday, November 23, 2019

Cobalt and Nickel Targets Super Strategic for IC Fabs

Purchase Reports Here: https://lnkd.in/dn7euVg

Monday, November 18, 2019

2020 CMC Conference & Call For Papers

Bruce Tufts, Vice President of Technology and Director of Fab Materials Org., Intel Corp.

The conference committee is soliciting presentations on best practices of sourcing direct and indirect manufacturing materials for pilot lines and for high-volume manufacturing (HVM). Three sessions will cover the following themes:

I. Global Value-chain Issues of Economics and Regulations,

II. Immediate Challenges of Materials & Manufacturing, and

III. Emerging Materials in R&D and Pilot Fabrication.

CMC member companies will be attending the public CMC Conference, which follows the annual members-only CMC meeting to be sponsored by Intel and held April 21-22. Conference attendees will include industry experts handling supply-chains, business-development, R&D, and product management, as well as academics and analysts. Business drives our world, but technology enables the profitable business of manufacturing new devices in IC fabs, and new devices need new materials.

To submit a paper for consideration, please send a 1-page abstract focusing on critical materials supply dynamics by January 15, 2020 to cmcinfo@techcet.com

Intel to Reclaim Number One Semiconductor Supplier Ranking in 2019

Thursday, January 10, 2019

Semiconductor Materials Market will be +3% to $50.4B in 2019

At the 2018 Critical Materials Council (CMC) Seminar, held last October in Ningbo, China in coordination with China's IC Materials Technology Innovation Alliance (ICMtia), representatives of global chip-makers including Intel, GlobalFoundries, and Texas Instruments discussed ways to ensure electronic materials supply-chain robustness in an era of short-sighted protectionist tariffs. All three companies have high-volume manufacturing (HVM) fabs in mainland China along with the US, and all need to source a wide range of specialty materials from global suppliers.

During private face-to-face meetings between CMC fab members in Ningbo, held just after the public CMC Seminar, ON Semiconductor shared that they have a plan prepared to deal with tariffs goings into effect at different levels. Established HVM chip fabs must keep sourcing specialty materials regardless of political whims, because our modern world relies on a steady supply of semiconductor devices to maintain our communications, entertainment, health-care, and transportation infrastructures.

Critical Materials Reports™ and Market Briefings: https://techcet.com/shop/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm focused on process materials supply-chains, electronic materials business, and materials market analysis for the semiconductor, display, solar/PV, and LED industries. Since 2000, the company has been responsible for producing the SEMATECH Critical Material Reports™, covering silicon wafers, semiconductor gases, wet chemicals, CMP consumables, Photoresists, and ALD/CVD Precursors. The Critical Materials Council (CMC) of semiconductor fabricators is a business unit of TECHCET, and includes materials supplier Associate Members. For additional information about reports, market briefings, CMC membership, or custom consulting please contact info(at)cmcfabs.org, +1-480-332-8336, or go to http://www.techcet.com or http://www.cmcfabs.org.

Friday, October 26, 2018

$70m lab for next-generation semiconductors at National University of Singapore with Applied Materials

Saturday, July 7, 2018

ALD/CVD Precursors Market Reaches $1.3B by 2023

Wednesday, February 7, 2018

CRITICAL EVENT FOR SEMI MATERIALS - April 26-27 Phoenix

Keynote speaker David Bloss, VP of Technology and Manufacturing Group, and Director of Lithography Technology Sourcing in Global Supply Management, Intel Corp., will start the three-session event exploring:

* Updates on market dynamics and government regulations,

* Trends in the profitable control of all fab materials, and

* Technology forecasts for future critical materials.

Join us in the Phoenix area: http://cmcfabs.org/cmc-events/

Saturday, January 6, 2018

Lam Research and Tokyo Electron took market shares in 2017

The three companies compete in the following areas with huge growth due to the memory boom in 2017 (3DNAND and DRAM):

- conductor and dielectric etch equipment

- deposition equipment - single/multiwafer ALD and CVD

SEMI Data Projects New Highs in Fab Equipment Spending. #semiconductor https://t.co/JfCpJD6wSR pic.twitter.com/2RRCYi2Iu0— SEMICON (@SEMIexpos) January 3, 2018

Friday, January 5, 2018

Memory chips led the way in 2017 boosting a 22% record semiconductor growth in revenue

Wednesday, January 3, 2018

Get back to work - SEMI projects continued boom in fab equipment spending for 2018

The SEMI World Fab Forecast data shows fab equipment spending in 2017 totaling US$57 billion, an increase of 41 percent year-over-year (YoY). In 2018, spending is expected to increase 11 percent to US$63 billion.

While many companies, including Intel, Micron, Toshiba (and Western Digital), and GLOBALFOUNDRIES increased fab investments for 2017 and 2018, the strong increase reflects spending by just two companies and primarily one region.

Friday, July 29, 2016

TECHCET Reports Record Silicon Wafer Shipments

For more detailed information and added insight on SOI, China and 450mm wafers, the reader is referred to TECHCET's Critical Materials Report(TM) on the Silicon Wafer Market and Supply Chain.

Critical Materials Council and/or China's supply chain?

Wednesday, June 22, 2016

Hydrogen Peroxide Gas Delivery for ALD, Annealing, and Surface Cleaning in Semiconductor Processing

Atomic Layer Depostion

“ALD is now firmly established as a key enabling technology. Today, ALD has become a critical technology for the manufacture of virtually all leading-edge semiconductor devices. The leading customers in our industry have already ramped several device generations based on our ALD equipment – for high-k metal gate applications in logic and foundry and for multiple patterning applications in the memory sector.”

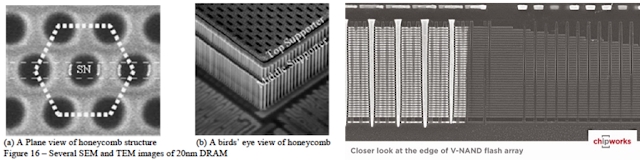

The 3D challenge in high aspect ratio structures

The new atomically ultrathin films are more sensitive to environmental conditions than thicker structures from past design nodes. Precise cleaning and preparation is required to prevent atoms from straying into other layers. Complicating the process is that these layers are no longer planar, but are three dimensional shapes with very high aspect ratios approaching 150:1 for DRAM memory cell capacitors and 3DNAND flash memory charge trap devices, creating inverted skyscrapers on an atomic layer.

Samsung presented a low cost manufacturing of 20 nm DRAM and beyond at IEDM2015 using honeycomb structure narrow gap air-spacer technology (left). For visualisation, here (right) the advanced High Aspect Ratio etch and ALD that is required for 3DNAND flash memory manufacturing in a reverse engineering cross section by Chipworks from a SAMSUNG V-NAND Flash array.

- Chemicals must be stable enough to reach the bottom, but reactive enough to be effective when they contact the bottom target site.

- Low temperatures are needed to prevent migration of atoms in and out of the layers, so the chemicals must be active at low temperatures.

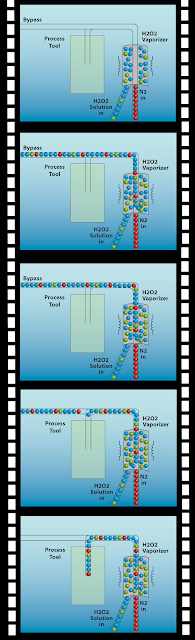

RASIRC specializes in products that generate and deliver gas to fabrication processes. Each unit is a dynamic gas plant in a box—converting common liquid chemistries into safe and reliable process gas on demand.. First to generate ultra-high purity (UHP) steam from de-ionized water, RASIRC technology can now also deliver hydrogen peroxide gas in controlled, repeatable concentrations.

Hydrogen Peroxide Gas (HPG) is a powerful and versatile oxidant for processing new materials and 3D structures. HPG is now available in stable, high concentration and offers significant benefits to ALD, annealing and cleaning applications. The Peroxidizer is an order of magintude improvement over its predecessor and overcomes the limits of pre‐humidification and high concentration H2O2 liquid supply by concentrating liquid inside the vaporizer. It handles gas flows of 5 to 30 slm in vacuum or atmospheric conditions. It delivers H2O2 concentrations from 12,500 to 50,000 ppm, which equates to 1.25 to 5% gas by volume. The Peroxidizer delivers a 4:1 water to Peroxide ratio. This is not possible with other high temperature vaporization methods due to H2O2 decomposition.

The membrane used in the vaporizer preferentially vaporizes H2O2 relative to water. This allows the concentration to stay below 75% and 90°C in the vaporizer while being able to generate 50,000 ppm. The fab only needs to supply 30% w/w, which is already in use throughout most facilities.

Hydrogen peroxide is a hazardous chemical and must be handled properly to prevent exposure of operators to unsafe chemical conditions. With proper design, installation, and operator training, hydrogen peroxide can be a viable alternative to other oxidants. The Peroxidizer includes a range of safety features focused on temperature, concentration, pressure, liquid and gas leak detection, venting and liquid handling.

H2O2 is auto‐refill capable. If a continuous supply of 30% H2O2 liquid is available, the Peroxidizer can run 24/7. For R&D, the Peroxidizer can be manually refilled with an internal source container to run 4 to 24 hours depending on flow rate.

- Primary interlock loop will shutoff power when any of a number of safety conditions occur.

- Temperature safeties include redundant thermal interlocks with thermal switches for heaters.

- H2O2 liquid and headspace temperatures are interlocked into the safety control loop.

- Concentration safety features include level sensors for overfill and low liquid conditions. If liquid level is too low, an alarm is displayed and carrier gas turned off to prevent further liquid concentration.

- Pressure safety features include direct pressure monitoring, pressure relief, and direct vent lines to channel high pressure vapor directly to scrubbed exhaust in case of overpressure conditions.

- Leak safety features include a flood sensor to detect liquid leaks.

- The system is ducted for exhaust ventilation to prevent HPG exposure in case of H2O2 liquid or gas leak. A ventilation pressure switch will trigger the interlock loop if ventilation is not adequate. A ppm HPG monitor is recommended in the exhaust ducting.

- The drain line has a float switch to monitor for drain back up.

- An optional condenser is available to condense HPG and water vapor before it goes to vent. Alternatively, scrubbers can be used to convert HPG directly to oxygen and water.

[2] ASMi Annual Reporting (2015)

%20(1).png)