Nanexa AB's rights issue, aimed at raising SEK 121m, concluded with a 34.7% subscription rate using rights and without. The company will utilize guarantee commitments for the remaining 27.1%. The rights issue, announced on September 21 with backing for 62% of the total, resulted in 33.5% of shares subscribed with rights and 1.2% without. The capital raised before transaction costs will be SEK 75m. Trading in BTAs will occur until registration is completed around week 45, 2023, with the new shares expected to trade on Nasdaq First North Growth by week 46, 2023.

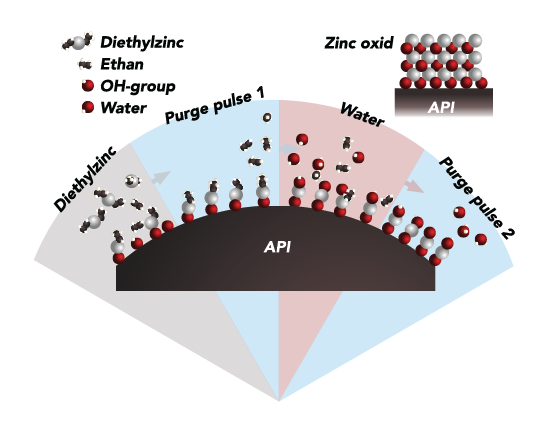

Nanexa, founded in 2007, has evolved from working with Atomic Layer Deposition (ALD) technology for various applications to focusing on the pharmaceutical sector with its proprietary PharmaShell® system. PharmaShell® positions Nanexa in the burgeoning drug delivery market with a system that allows high-precision, long-acting injectable drug products. The company is developing its own products and also partners with multiple pharmaceutical firms, including AstraZeneca, leveraging the unique capabilities of its ALD-based technology to enhance drug delivery.

%20(1).png)

No comments:

Post a Comment