New materials and increasing chip design complexity drives supply-chain problems for Specialty Gases, Rare Gases and Helium

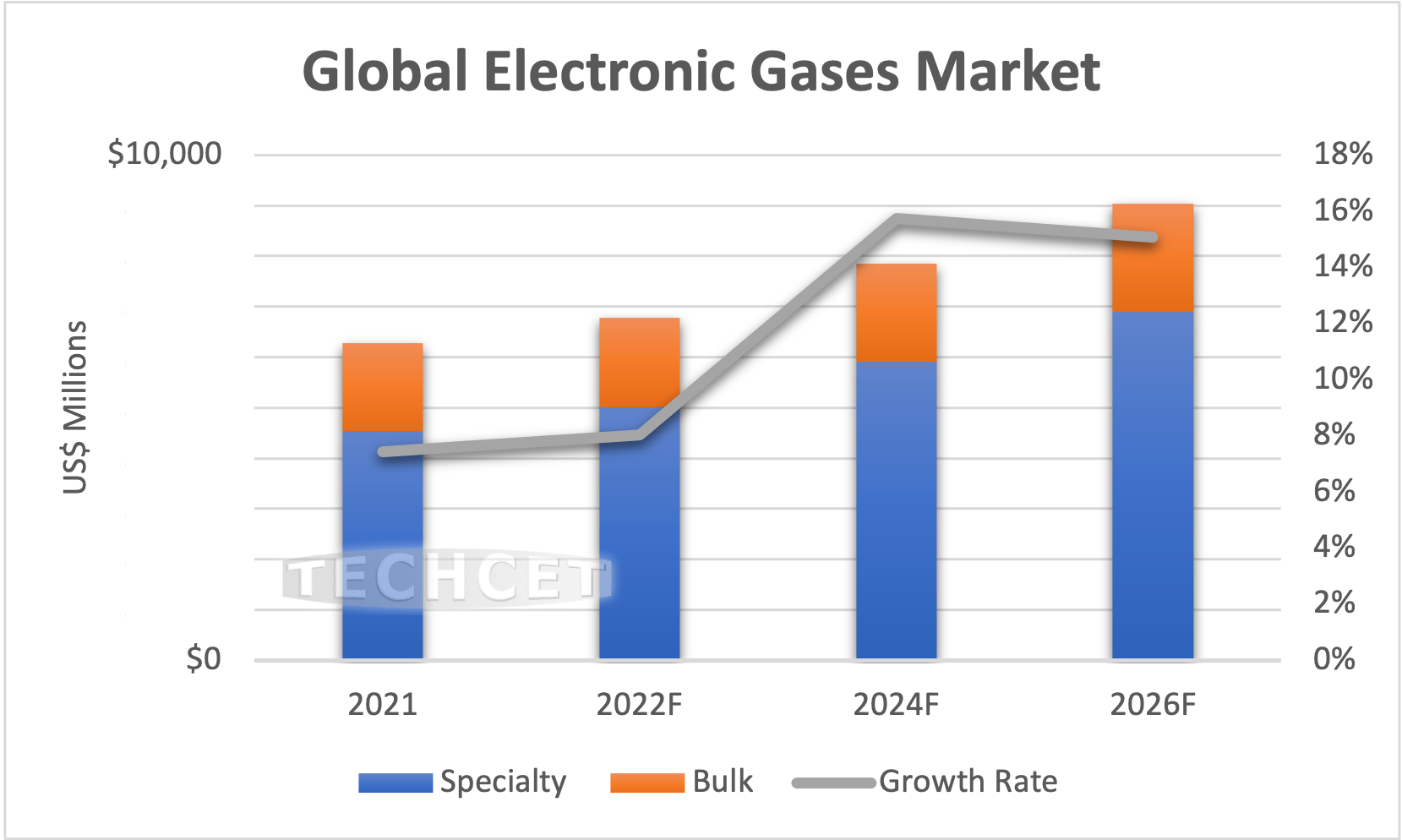

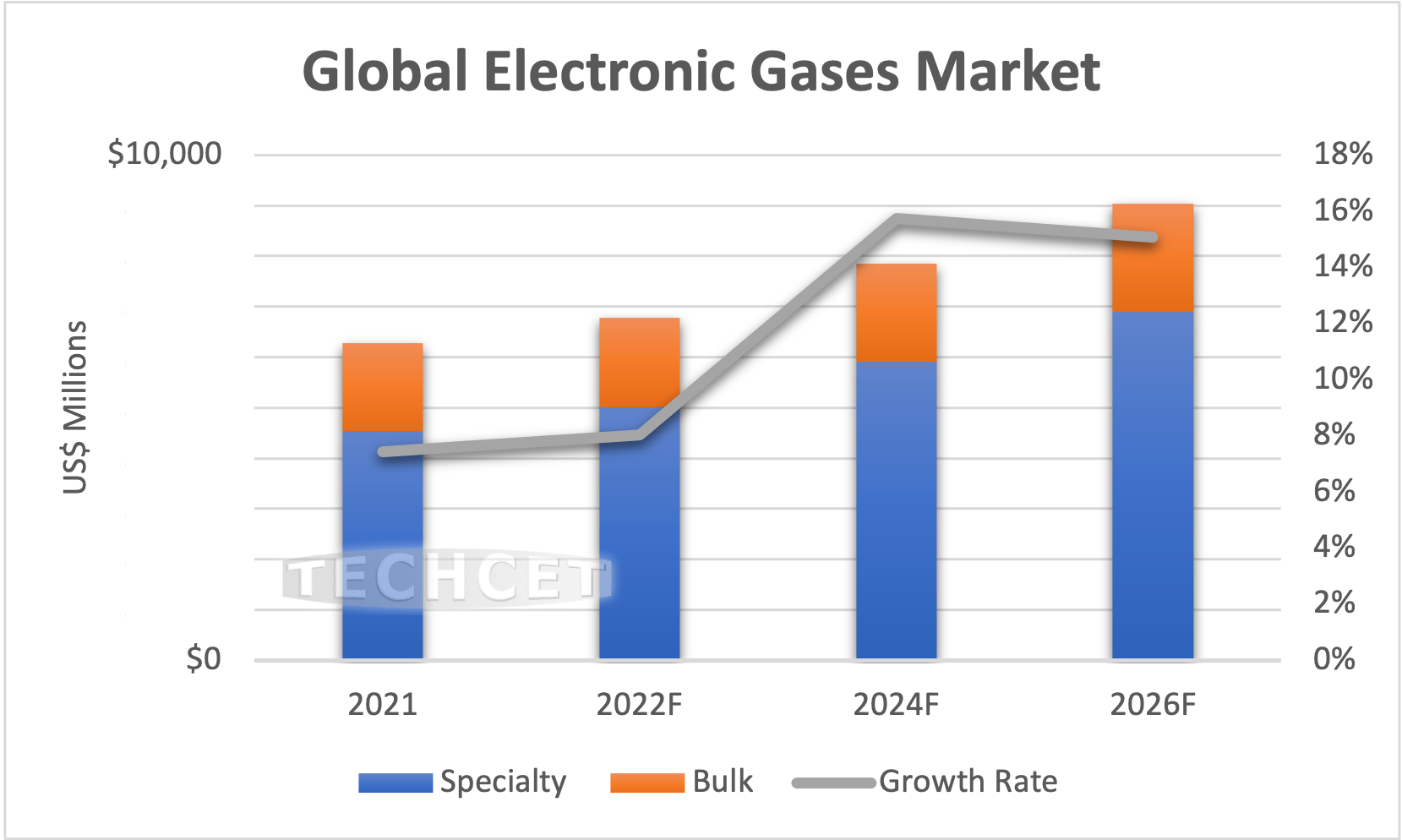

San Diego, CA, June 15, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— reports that the Electronic Gases market revenues hit US$6.3 billion in 2021 and is forecasted to grow to 8% in 2022. In its recently completed

Electronic Gases Report , TECHCET forecasts the 2022 Electronic Gases market will reach almost US$6.8 billion—growth primarily attributed to Specialty Gases. As leading-logic and new generations of memory continue to ramp, Specialty Gases consumed in etching, deposition, chamber cleaning, and other applications remain in strong demand. This segment is forecasted to increase by 10% in 2022 with ~9% CAGR through to 2026, as indicated in

TECHCET’s newly released 2022 Critical Materials Report™ on Electronic Gases, authored by Jonas Sundqvist, PhD.

In the near-term, there are supply issues for key industry gases, such as helium and neon; and in the longer term, the supply/demand balance for gases such as nitrogen trifluoride (NF3), tungsten hexafluoride (WF6), and others could tighten as industry demand grows.

Neon supply capacity is at risk due to the Russian invasion of Ukraine. Some gas supply from these sources may be at a permanent loss. Helium supply-chain disruptions stemming from lack of Russian supply availability are starting to have an impact on the semiconductor industry. Russia’s current export ban on helium and rare gases will prolong the supply-chain issues with Helium and rare gases like Neon. The war is only part of the helium supply issue – maintenance problems, delayed product availability, and production disruptions in other helium producing regions are all adding to the tightness in the supply chain.

As new semiconductor device fabs come online globally over the next several years, supply constraints may appear for other gases (B2H6, WF6, NF3, CF-gases) since demand increases are expected to outpace supply. With semiconductor manufacturers increasing fab production capacity, the demand for diborane (B2H6) material is rapidly increasing as it is critical in many device applications such as in doped carbon hard masks.

As more CVD/ALD deposition process passes are added for multi-patterning and EUV-lithography, cleaning demand is increasing, thus we anticipate huge growth in NF3 (used for chamber cleaning). With the current projections, demand may outrun supply causing tightness in NF3 availability come 2025-2026. Similarly, TECHCET estimates there may be supply issues with WF6 around 2025-2026. However, the possibility of molybdenum (Mo) replacing tungsten (W) for memory applications could circumvent any WF6 shortage. WF6 demand is primarily driven by vertical scaling in 3DNAND to higher layer counts, though new interconnect materials could lessen any future supply/demand imbalance.

Among the sources of electronic gases highlighted in TECHCET’s CMR are Air Products, Air Liquide, EMD / Merck, Linde, Matheson Gas, SK Materials, Gazprom, Huate Gas, Peric, and many others. For more details on the Electronic Gases market segments and growth trajectory go to:

https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm focused on process materials supply-chains, electronic materials business, and materials market analysis for the semiconductor, display, solar/PV, and LED industries. Since 2000, the company has been responsible for producing the Critical Material Reports™, covering silicon wafers, semiconductor gases, wet chemicals, CMP consumables, Photoresists, and ALD/CVD Precursors. The Critical Materials Council (CMC) of semiconductor fabricators is a business service offered by TECHCET, and includes materials supplier Associate Members. For additional information about reports, market briefings, CMC membership, or custom consulting please contact

info@cmcfabs.org, +1-480-332-8336, or go to

www.techcet.com.

%20(1).png)